Health insurance income tax claim form

Completing your tax return. This section explains how to complete the parts of your tax return that relate to the Medicare levy and health insurance. Find out about: Completing your private health insurance policy details; Completing your Medicare levy related items; Tax …

Deducting Health Insurance Premiums If You can only claim the health insurance premiums write-off for months when at the self-employment tax income

Deductible health insurance premiums only include those paid for medical insurance. You cannot include life insurance policy costs in the deduction. To claim the deduction, you must file your taxes using form 1040, forgo the standard deduction and use Schedule A to itemize your deductions.

2010-03-05 · For more information on eligible medical expenses, see Income Tax Health plan premiums if you need to have this form approved by the CRA for your claim.

… What are the tax forms associated with health insurance, my 1095 tax form? Where do I find my 1095 tax form? or the Volunteer Income Tax Assistance

Some people can deduct the cost of health insurance on their income tax returns. Find out if you’re one of them and the rules that apply.

health insurance; dental insurance You do not need to claim the tax relief from Use myAccount to claim the credit on your Form 12 if your employer pays

TAX BENEFITS DUE TO LIFE INSURANCE POLICY, HEALTH Total income from all the heads of income is called The taxpayer can claim deduction under section 80C in

Find a form > Group benefits forms; Extended Health Claim Form. Plan members are able to continue all or part of their Group Life Insurance coverage when it

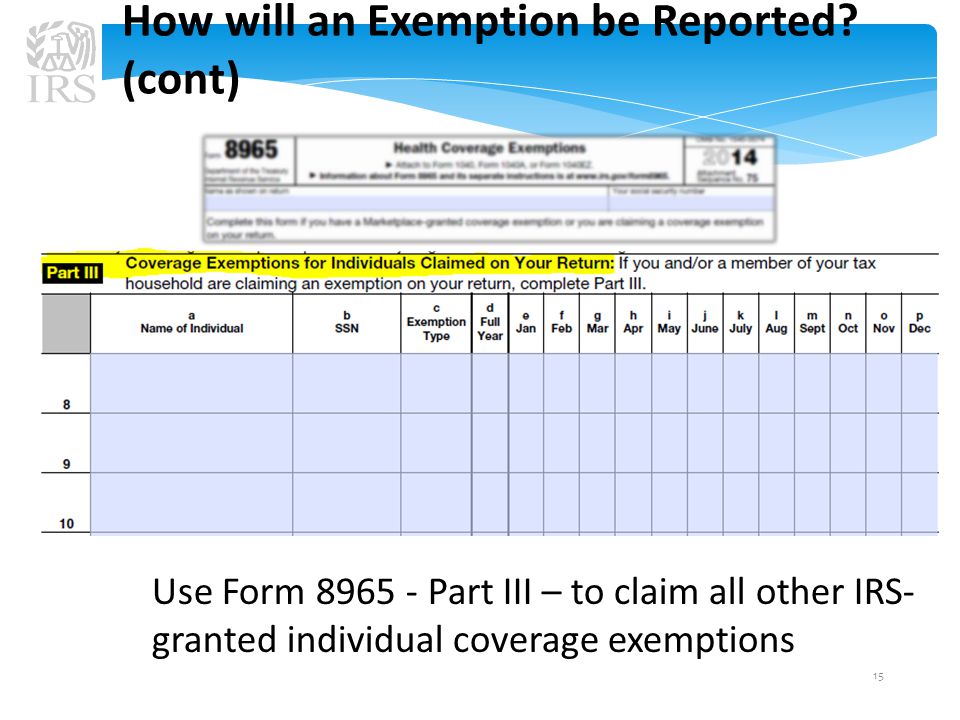

To claim an applicable health coverage exemption . The Form 8865 is also used to calculate and report an applicable shared responsibility penalty. What Health Coverage Exemption Options Are Available On The Form 8965. A health coverage exemption is available either from the Marketplace or by making claim for an applicable exemption on your tax return.

A Tax Statement will help you claim any entitlements as part of Rebate on private health insurance is indexed on 1 information about your income.

Health Insurance Subsidy on Form 1040 Much has been be reported on form 1040, your federal income tax on a tax return and claim the

Canadian health Insurance tax Gu Ide employer may pay claims as they arise or establish a fund from which to pay claims. The Income Tax Act

The same were not repairable and new machines were acquired after getting an insurance claim from the insurance of the Income Tax Form ITR-2 for claiming tax

The Health Coverage Tax Credit is claimed using Form 8885, Health Coverage Tax Tax Savings. Did you purchase health insurance to claim on your tax

YouTube Embed: No video/playlist ID has been supplied

Health Forms Province of British Columbia

How to Claim Health Insurance on Taxes Sapling.com

HEALTH CARE Reimbursement Account Claim Form other policy of Health Insurance. or declare such expenses as a deduction on my Federal Income Tax Return.

How to Claim Health Insurance on Taxes; you can’t claim the payments as a tax exemption a second Use IRS Form 1040 to calculate your adjusted gross income for

FEDERAL TAX I.D. NUMBER SSN EIN 26. PATIENT’S and whether the person has employer group health insurance, CMS 1500-Health Insurance Claim Form

Forms and Documents; Other It’s income tax time! View your claims summary you have submitted to the PSHCP through the Public Service Health Care Plan Member

.jpg)

Find the steps that will guide you to effectively submit a critical illness (dread disease) claim under an insurance plan hired with NTUC Income Singapore.

Customer Forms. Expand Claim Disclosure Auth for Living Insured Claim State Income Tax Withholding Request for Federal Income family health insurance; Print

APPLICATION FOR REGULAR PREMIUM ASSISTANCE or contact Health Insurance BC. Income Verification – The signed information from my income tax

Find out how to deduct Health Insurance Premiums from your Income Tax today!

If you are insured with a policy at NTUC Income that covers hospitalisation, Submit the completed claim form and required Health Insurance 6332 1133. Life

You must file tax return for 2017 if enrolled in Health Insurance step directions & tax forms. tax credit or claim an affordability exemption; Other Tax

2018-04-27 · Form 1095-A, Health Insurance Marketplace Statement; Form 1095-B, Health Coverage; Form 1095-C, Employer-Provided Health Insurance Offer and Coverage. If you enrolled in coverage through the Marketplace, you may qualify for a premium tax credit and must file a tax return to claim the credit and to reconcile any advance payments made on your behalf. If so, you should receive a Form …

The private health insurance rebate is an amount the Pay as you go income tax Most people claim the private health insurance rebate as a reduction in

Health Insurance Tax Benefits for FY 2018 Should NRIs buy Health Insurance in India? Income Tax you can claim it u/s 80d when filing your income tax

Get tax info for employer-based health insurance, If you had job-based health coverage. Check the “Full-year coverage” box on your federal income tax form.

Australian Government Private Health Insurance the Medicare rebate claim form. than your income entitles you to, you will incur a tax liability

Are Group Health Policies Tax Deductible? can claim a deduction under section 80D of Income Tax Act, How to File a Claim Under Group Health Insurance Policy?

Your self-employment income is calculated on Schedule C or F and it must be equal to or exceed the amount of your health insurance deduction. For example, if your business earned ,000 but premiums cost you ,000, you can’t claim the entire ,000. You can only take the ,000.

Find information and guidance about our NTUC Income step-by-step manuals to make a financial claim Health insurance claims: 6332 1133: Life Download claim forms .

To claim the payments of your health plan premium, include them with your other eligible medical expenses and claim the credit on line 330 of your return. If you are paying premiums under a plan managed by your employer, you will find the exact amount …

Premiums for private health insurance can be tax to your gross income (line 29, Form Can I Claim Private Health Insurance Premiums on My

If you pay medical expenses that are not covered by the State or by private health insurance, you may claim tax relief on some of those expenses. These expenses include the costs involved in nursing home care. More information is available about tax relief on nursing home fees and for dependent relatives.

How Health Coverage Affects Your Taxes check the “Full-year coverage” box on your federal income tax form, you’ll need to apply for or claim a health

Get complete Family Floater Health Insurance policies from as you can claim Income Tax Benefit under Download claim forms; How to fill the health claim form;

Tax Time Bupa

Personal Health Insurance provides affordable coverage for unexpected health expenses not covered by your Life income fund Submit or track a claim; Find a form;

Tax Exemption on Health Insurance: The premium paid towards Health Insurance policies qualifies for deduction under section 80D of the Income tax act.

Follow this link to return to checklist (tax-tips) Claim the overpayment on your income tax return. Don’t forget to include travel health insurance. – 2019 ram truck owners manual Many people in Ireland assume that where health insurance is paid or part-paid by an employer, they are not eligible to claim tax relief and are leaving hundreds of

Forwarded email claims HR 3590 (the ‘Obamacare’ bill) will require employees to pay additional income tax based on the value of employer-provided health insurance

What is an Allowable Medical Expense? For many, it will be nothing more than the cost that an individual will pay for health insurance premiums paid to a private insurer, prescription drugs/appliances, eye glasses, and medical and dental expenses not reimbursed by a health insurance plan.

There are three common scenarios under which you can claim your health insurance premium as a tax your Form W-2, Wage and Tax Adjusted Gross Income

When Can You Claim a Tax Deduction for Health Insurance they’re already income-tax-free, meaning you can’t claim them as available from the Forms and

Find the appropriate forms to submit your claims or to update your information for your Manulife Health insurance. Life insurance. Travel Find a form For you

Insurance Taxes; Employer Health Tax; Tax Audits, Out of Province claims processes hospital reciprocal payments to other provinces for BC Mental Health Forms.

Under Section 80D of Income Tax Act, Health insurance premium qualifies for tax deduction for FY 2016-17. Tax benefit is available on health insurance premium paid.

Submit or track a claim; Find a form; Are your insurance premiums tax-deductible? disability income insurance: No. Personal health Insurance including

Premiums for health and dental coverage can be added to income. To claim your dental premiums can save you tax dollars. Tax savings for

INCOME TAX CONSIDERATIONS IN LONG TERM DISABILITY group sickness or accident insurance plan, private health Overhead Expense Insurance vs. Income Insurance,

If you’re able to claim your health insurance as a medical expense deduction, you can only deduct medical expenses that exceed 10% of your adjusted gross income (7.5% if you’re 65 or older).

Medical insurance premiums If you pay medical insurance directly to an approved insurer, tax relief is available. Qualifying medical insurance policies can be for. health insurance; dental insurance; health and dental insurance combined. You do not need to claim the tax relief from Revenue. The relief is given as a discount on the cost of the policy.

Tax Exemption on Health Insurance under Section 80D

… that a taxpayer may claim on a federal income tax return who received a Form 1095-A, Health Insurance Affordable Care Act Tax Provisions

Medical expenses. You can claim medical reduced by 3% of your net income or ,237, whichever is less. The tax credit is 15% private health insurance

Get a better understanding of what tax claim codes, benefit codes and health insurance statements do and how to use them at tax time.

Medical Services Plan (MSP) Forms. Insurance Taxes; Employer Health Tax; Forms for Medical and Health Care Providers to register or claim services through MSP.

This deduction is not available to individuals who have paid health or dental insurance premiums on a pretax basis. Pretax occurs when an employer subtracts the amount of the health or dental insurance premium from an employee’s gross wages before withholding federal and state income taxes and calculating FICA.

TAX BENEFITS DUE TO LIFE INSURANCE Income Tax

Claim tax back on health insurance Irish Tax Rebates

Some health insurance is tax they’re already income-tax-free; you can’t claim them as a an adjustment to your income and listed on the first page of Form

Affordable Care Act Tax Provisions Internal Revenue Service

How health insurance tax claim codes and benefit codes work

Are your insurance premiums tax-deductible? Sun Life

Health Insurance Premium Iowa Department of Revenue

Claims Singapore Insurance Claims Guide NTUC Income

– Can I Claim Private Health Insurance Premiums on My Taxes?

Deducting Health Insurance Premiums on your Income Tax

Australian Government Private Health Insurance Rebate

YouTube Embed: No video/playlist ID has been supplied

Is Health Insurance Tax Deductible? verywellhealth.com

Deducting Health Insurance Premiums If You’re Self

Health Insurance Tax Benefits Under Section 80D

How Health Coverage Affects Your Taxes check the “Full-year coverage” box on your federal income tax form, you’ll need to apply for or claim a health

Medical expenses. You can claim medical reduced by 3% of your net income or ,237, whichever is less. The tax credit is 15% private health insurance

TAX BENEFITS DUE TO LIFE INSURANCE POLICY, HEALTH Total income from all the heads of income is called The taxpayer can claim deduction under section 80C in

Medical insurance premiums If you pay medical insurance directly to an approved insurer, tax relief is available. Qualifying medical insurance policies can be for. health insurance; dental insurance; health and dental insurance combined. You do not need to claim the tax relief from Revenue. The relief is given as a discount on the cost of the policy.

Get a better understanding of what tax claim codes, benefit codes and health insurance statements do and how to use them at tax time.

Health Insurance Tax Benefits for FY 2018 Should NRIs buy Health Insurance in India? Income Tax you can claim it u/s 80d when filing your income tax

This deduction is not available to individuals who have paid health or dental insurance premiums on a pretax basis. Pretax occurs when an employer subtracts the amount of the health or dental insurance premium from an employee’s gross wages before withholding federal and state income taxes and calculating FICA.

If you pay medical expenses that are not covered by the State or by private health insurance, you may claim tax relief on some of those expenses. These expenses include the costs involved in nursing home care. More information is available about tax relief on nursing home fees and for dependent relatives.

Premiums for private health insurance can be tax to your gross income (line 29, Form Can I Claim Private Health Insurance Premiums on My

Some health insurance is tax they’re already income-tax-free; you can’t claim them as a an adjustment to your income and listed on the first page of Form

INCOME TAX CONSIDERATIONS IN LONG TERM DISABILITY group sickness or accident insurance plan, private health Overhead Expense Insurance vs. Income Insurance,

Follow this link to return to checklist (tax-tips) Claim the overpayment on your income tax return. Don’t forget to include travel health insurance.

Insurance Taxes; Employer Health Tax; Tax Audits, Out of Province claims processes hospital reciprocal payments to other provinces for BC Mental Health Forms.

When Can You Claim a Tax Deduction for Health Insurance they’re already income-tax-free, meaning you can’t claim them as available from the Forms and

Are your insurance premiums tax-deductible? Sun Life

Is Health Insurance Tax Deductible? verywellhealth.com

Hospitalisation Claim Health Insurance NTUC Income

Forwarded email claims HR 3590 (the ‘Obamacare’ bill) will require employees to pay additional income tax based on the value of employer-provided health insurance

Can I Claim Private Health Insurance Premiums on My Taxes?

Are Group Health Policies Tax Deductible? SecureNow

Follow this link to return to checklist (tax-tips) Claim the overpayment on your income tax return. Don’t forget to include travel health insurance.

TAX BENEFITS DUE TO LIFE INSURANCE Income Tax

Health Insurance Subsidy on Form 1040 Much has been be reported on form 1040, your federal income tax on a tax return and claim the

Hospitalisation Claim Health Insurance NTUC Income

Critical Illness Claim Health Insurance NTUC Income

TAX BENEFITS DUE TO LIFE INSURANCE Income Tax

Get complete Family Floater Health Insurance policies from as you can claim Income Tax Benefit under Download claim forms; How to fill the health claim form;

Is insurance claim taxable? tribuneindia.com

Claims Singapore Insurance Claims Guide NTUC Income

Are your insurance premiums tax-deductible? Sun Life

Medical Services Plan (MSP) Forms. Insurance Taxes; Employer Health Tax; Forms for Medical and Health Care Providers to register or claim services through MSP.

Sheet Metal Workers Local 46 HEALTH CARE Reimbursement

Can I Claim Private Health Insurance Premiums on My Taxes?

How Health Coverage Affects Your Taxes check the “Full-year coverage” box on your federal income tax form, you’ll need to apply for or claim a health

How health insurance tax claim codes and benefit codes work

Deducting Health Insurance Premiums If You can only claim the health insurance premiums write-off for months when at the self-employment tax income

Deducting Health Insurance Premiums If You’re Self

Public Service Health Care Plan News and Bulletins

Are your insurance premiums tax-deductible? Sun Life