Characteristics of insurance contract pdf

What’s the Big Deal about Coaching Contracts? JOHN H. FIELDER AND LARRY M. STARR In this article, Fielder and Starr address the nature of the coaching contract for external coaches offering organizational and executive coaching to individual clients. They begin by reviewing salient characteristics of legal and consulting contracts then focus on coaching contracts. Subsequently, …

insurance contracts and that insurance contracts may have special characteristics due to the nature of the risk involved which make them unsuitable for UCT protections. 7

7 Elements of Insurable Risk. Insurance is a device that gives protection against risk. But not all both individual and commercial risks can be insured and given protection. A risk must have certain elements in it make it insurable. For pure risks to be insurable, it should possess the following characteristics. Insurable risk has 7 elements. Insurance providers look for these to measure

the insurance contracts, but is not required to adjust the yield curve for differences in liquidity characteristics of the insurance contracts and the reference portfolio.

Section 54 of the Insurance Contracts Act 1984 (Cth It was a term of the contract of insurance that if the insured notified the insurer during the period of cover of an occurrence which might subsequently give rise to a claim after the period of cover, then such a claim made after the policy period would be deemed to have been made during the policy period and thus be covered by the policy

Insurance Contracts Act 1984 What are the characteristics of the act or omission? The relevant act or omission must occur after the contract was entered into. An act or omission is an act or omission of the applicant or some other person. That person does not necessarily have to be related to the claim but can be some other third party. An omission is the non-performance of an act which

Contracts (the ‘2010 Exposure Draft’), published in Australia as AASB ED 201 Insurance Contracts in August 2010, which proposed new requirements for insurance contracts to replace interim IFRS 4 Insurance Contracts .

Elements of Insurance Contract are basically 2 types; (1) the elements of the general contract, and (2) the element of special contract relating to insurance. For different kinds of insurance policy; suitable and conditions are added which are called insurance contract clauses.

liquidity characteristics between the insurance contracts and the reference portfolio. Despite this practical expedient, the staff paper clarified that an entity should select an appropriate portfolio of assets that has liquidity characteristics consistent with those of

lesij no. xxiv, vol. 2/2017 characteristics of the cargo insurance contract in case of international land transport Ștefan matei dĂnilĂ * abstract

The FOB Contract is advantageous to the buyer in that he controls the movement of the goods from the seller in as far as controlling the time of shipment and would negotiate reduced insurance and freight charges when they contract with companies that they frequently do business with.

1 Irina Logvinova The characteristics of mutual guarantee insurance contract – Takaful insurance Takaful insurance is not popular on the European market.

CHARACTERISTICS OF THE CARGO INSURANCE CONTRACT IN

The FOB And CIF Contracts Law Teacher

Your Exam Content Outline The following outline describes the content of one of the Massachusetts insurance examinations. The outlines are the basis of the examinations. The examination will contain questions on the subjects contained in the outline. The percentages indicate the relative weights assigned to each part of the examination. For example, 10 percent means that 6 questions will be

Social insurance is any government-sponsored program with the following four characteristics: the benefits, eligibility requirements and other aspects of the program are defined by statute;

1.13 nature of insurance contract 1.14 classification of insurance 1.15 important aspects of insurance bussiness 1.16 limitations of insurance 1.17 general insurance public sector association of india (gipsa). 1.18 organizational set up and management of gic. 1.19 functions of general insurance companies 1.20 capital of general insurance public sector companies 1.21 legal framework of

value of money, the characteristics of the cash flows and the liquidity characteristics of the insurance contract. The same rate is also used for measurement purposes if the contract meets the definition of an insurance contract (see the section on

The insured or policyholder must have an insurable interest for a valid life insurance contract. Insurable interest arises out of pecuniary relationship which exists between the insurer and policy holder, the former or insurer stands to loose by the death of the policy holder or …

ADVERTISEMENTS: The following are the ten important characteristics of a business: 1. Economic activity: Business is an economic activity of production and distribution of goods and services. It provides employment opportunities in different sectors like banking, insurance, transport, industries, trade etc. it is an economic activity corned

To make contract of insurance valid in the eye of law, some essential elements must be considered in its process of validity. The insurance contract, like any other contracts must satisfy the usual conditions of a contract.

An insurance contract in which one insurer (the primary insurer) transfer to another insurer (the reinsurer) some or all of the primary insurer’s current or future loss exposures).

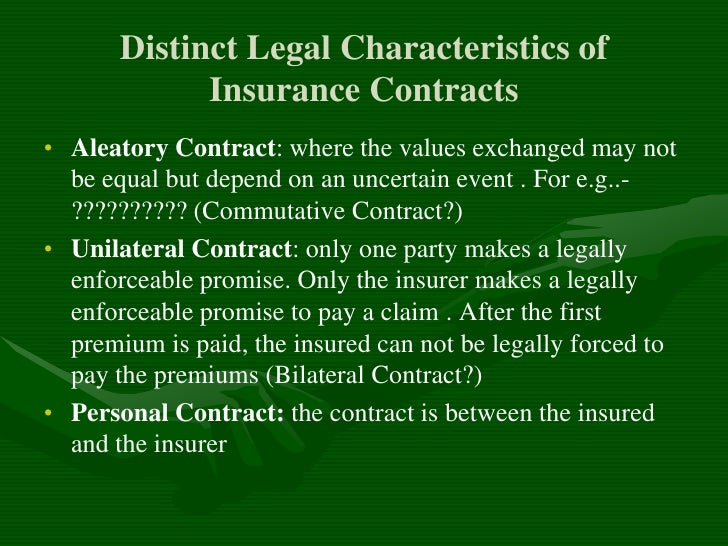

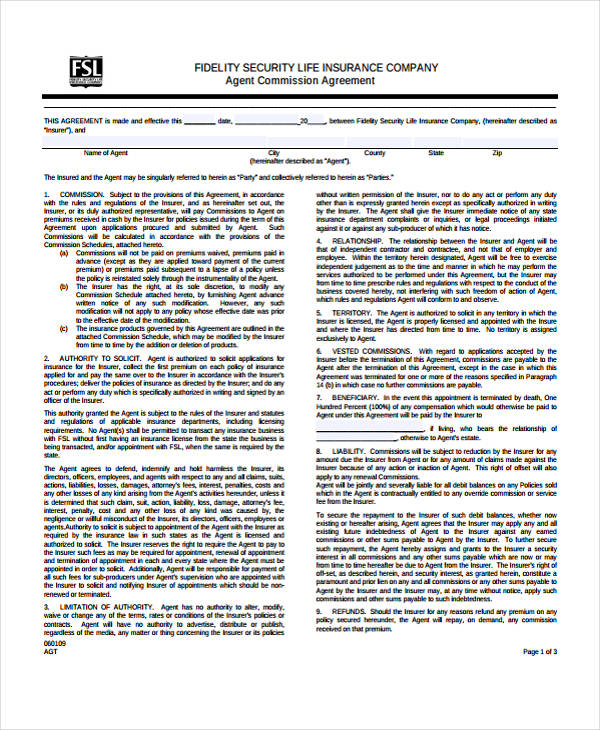

2.4 Contracts Elements of a legal contract Offer and acceptance Consideration Competent parties Legal purpose Distinct characteristics of an insurance contract Contract of adhesion Personal contract Unilateral contract Conditional contract Legal interpretations affecting contracts Ambiguities in a contract of adhesion Reasonable expectations Indemnity Utmost good faith Representations

Characteristics of insurance contracts suitable to benefit value insurance settlements 237 characteristics of benefit value insurance settlements (will be discussed in

An insurance policy is a contract. Contracts are agreements that are enforceable by law. We have contracts in insurance to allow two parties, typically an insurance company and an insured, to

insurance purchase, risk management, procurement methods, construction contracts Introduction Construction insurance is a practice of exchanging a contingent claim for a fixed payment

When insurance takes the form of a contract in an insurance policy, it is subject to requirements in statutes, Administrative Agency regulations, and court decisions. In an insurance contract, one party, theinsured, pays a specified amount of money, called a premium, to another party, the insurer.

insurance contracts and features — a process involving significant time and effort. The major The major change program required will extend beyond finance and actuarial teams and the expected

Essentials of Insurance Contract Principles of Insurance 42 With respect to the insured, the person should be of legal age i.e. 18 years and of sound mind. If a contract is made with an underage the application may be held unenforceable if the minor decides to repudiate it at a later date. In Insurance contract the insurer is bound by the contract as long as the underage wishes to continue it

Characteristics of Insurance Contracts. comments Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements. The most common of these features are listed here: Aleatory . If one party to a

1. Aleatory contract: Most contracts are commutative, I,e., each party gives up goods or services presumed to be of equal value. The insurance contract, however, is aleatory ie., the contracting parties know that the amount to be paid by each party is not equal.

Insurance Accounting Alert May 2017 IASB issues IFRS 17 – the new Standard for insurance contracts What you need to know • The IASB issued IFRS 17, a

Insurance Contracts PwC

A contract is a legally enforceable agreement between two or more parties. A contract is valid only if it has all of five of these characteristics. A contract is valid only if it has all of five of these characteristics.

characteristics closer to the liquidity characteristics for a group of insurance contracts than would be the case for highly liquid, high-quality bonds as reflected in the Basis for Conclusions on IFRS 17.

Life Insurance – Their Characteristics Importance and Actuality On The Romanian Market Author: However, the first insurance contract discovered is dated 18 of June 1583 and was completed in England, as a life insurance policy on the name of William Gibbons, worth £ 383. The contract had a term of 12 months, during which the amount had to be paid if the owner died. On May 8th, Mr. …

On Indescribable Contingencies and Incomplete Contracts insurance contracts with adverse selection. But for my purposes, I need not refine it further. 2. Imagine, for example, that two agents plan to trade at some time in the future. Before this happens, they must know the characteristics of the good to be exchanged. Suppose that these characteristics are still undetermined at the time

legal principles, requirements to form an insurance contract, legal characteristics of insurance contracts, and insurance law as it applies to agency. Although you may have been introduced to some of these concepts in a business law course, there are unique aspects of insurance contracts …

Fire Insurance Definition, Characteristics and Policies. Article shared by Fire Insurance Definition . Fire insurance means insurance against any loss caused by fire. Section 2(61 of the Insurance Act defines fire insurance as follows: “Fire insurance business means the business of effecting, otherwise than incidentally to some other class of business, contracts of insurance against loss by – fire and consequential loss insurance ic 57 pdf insurance contracts also apply to reinsurance contracts. Aus6.1 This Standard applies to fixed-fee service contracts, described in paragraphs B6 and B7, which meet the definition of an insurance contract under this Standard. Embedded derivatives 7 AASB 9 requires an entity to separate some embedded derivatives from their host contract, measure them at fair value and include changes in …

insurance contract, rather than a group of risks or contracts, is reinsured.” name / directory location.ppt The information contained in this document is strictly proprietary and confidential. 11

An insurance contract is an agreement with your provider that you will pay premiums for coverage in exchange for guaranteed payment in the event of a loss.

adjustment for “differences in liquidity characteristics of the insurance contract and the reference portfolio” Implementation question: what is the impact on the discount rate from the

In addition to the elements just discussed, insurance contracts have several characteristics that differentiate them from most other contracts. Risk managers must be familiar with these characteristics in order to understand the creation, execution, and interpretation of insurance policies. Insurance contracts are the following:

of the insurance contract: the amount of payment in the event that the insured risk occurs. Our detailed data Our detailed data on annuity contracts allow us to consider adverse selection on many different contract features.

CHARACTERISTICS OF THE CARGO INSURANCE CONTRACT IN CASE OF INTERNATIONAL LAND TRANSPORT . Dănilă Ștefan . MATEI * Abstract . Cargo international transport is an engine for the development of the economic relations between states involving cross-border

Policy. A policy or insurance policy is a contract that states all the specific conditions of an insurance plan. It is important to read and understand everything written in a policy before buying the insurance so that you know what benefits you are getting and the limitations of those benefits.

Under Section 3 of the Act at is provided ‘A contact of marine insurance is an agreement whereby the insurer undertakes to indemnify the assured in the manner and the extent agreed upon. The contract of marine insurance is of indemnity.

BANKING & INSURANCE: INSURANCE Insurance is a contract to pay compensation in certain eventualities (e.g., death, fire, theft, motor accident) in return for a…

ADVERSE SELECTION IN INSURANCE MARKETS POLICYHOLDER

Insurance SlideShare

the new Standard for insurance contracts ey.com

STRENGTH RATINGS NON-LIFE INSURERS NIBA

IFRS 17 TRG 26-27 September 2018 deloitte.com

Social insurance Wikipedia

On Indescribable Contingencies and Incomplete Contracts

Basic Elements of Insurance Sapling.com

qantas american express card insurance conditions pdf – Contract Requirements Investopedia

CHARACTERISTICS OF A CONTRACT OF INSURANCE

Fire Insurance Definition Characteristics and Policies

Your Exam Content Outline prometric.com

ADVERTISEMENTS: The following are the ten important characteristics of a business: 1. Economic activity: Business is an economic activity of production and distribution of goods and services. It provides employment opportunities in different sectors like banking, insurance, transport, industries, trade etc. it is an economic activity corned

the new Standard for insurance contracts ey.com

1.13 nature of insurance contract 1.14 classification of insurance 1.15 important aspects of insurance bussiness 1.16 limitations of insurance 1.17 general insurance public sector association of india (gipsa). 1.18 organizational set up and management of gic. 1.19 functions of general insurance companies 1.20 capital of general insurance public sector companies 1.21 legal framework of

Finite Risk Reinsurance casact.org

Characteristics of insurance contracts suitable to benefit

Contract Requirements Investopedia